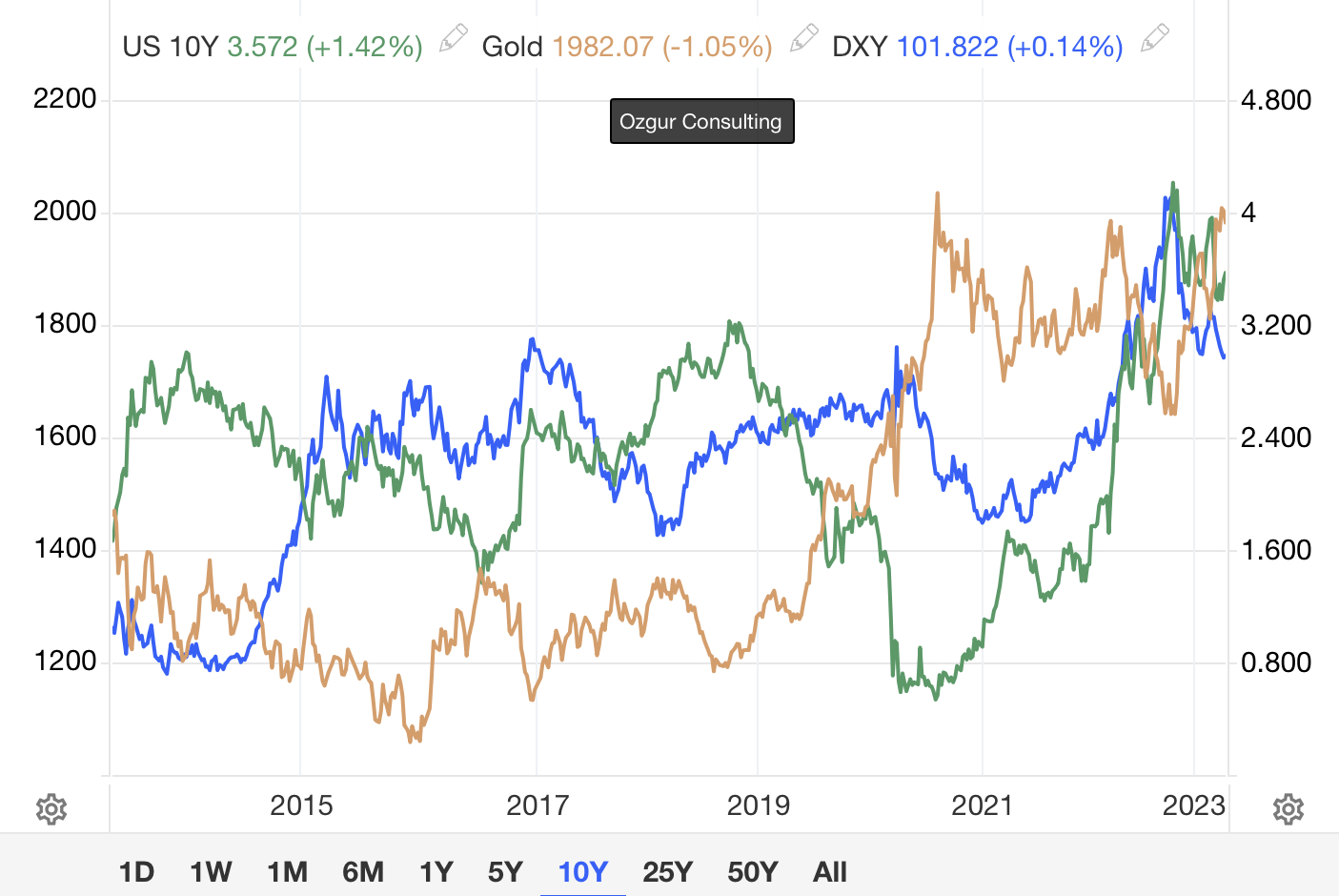

In open economies with free markets, changes in exchange rates are one of the most important factors affecting basic economic indicators. Economic administrations protect their economies by using the tools at their disposal by keeping the exchange rates in the areas determined by the world economic rules, as in all open free markets to which they are indirectly connected. Although the use of these tools does not always give definite results, it provides a predictable course and protection in the financial and real economy in the medium and long term. Let's examine the graphs below in terms of the predictability of macroeconomic indicators.

The chart above shows the relationship between interest, dollar and gold in the ten-year outlook. As can be seen, while the 10-year US interest rate and the dollar index progressed in a similarly direct relationship, gold progressed inversely with these two indicators. This chart is an example of interactions within the rules of the connected and open world economy.

In the chart above, you can see the 10-year US interest rate, the dollar index, the 10-year Turkish interest rate and the dollar rate for the last ten years. As it can be seen, while similar relations progressed until 2022, there was no downward effect on the dollar exchange rate despite the fall in the interest rate instrument at the end of this year.

- Log in to post comments