If we accept the costs of any material until it enters the warehouse as the purchasing cost, we can calculate the inventory costs starting from the warehouse entry costs, over the costs that will occur until the time it is put into production. Many components such as inventory amount, loading and unloading expenses, warehouse location selection, storage type, material stacking, handling, insurance expenses, inflation, employee expenses, labeling, monitoring and control affect inventory costs. It is important to keep all these components between optimum values.

When calculating the inventory cost; market price cost, realization cost, standard cost is based on principles such as. Inventory values are determined by using methods such as average cost, real cost, FIFO, LIFO, LOFO, HIFO. While expiration dates are not considered in the cost calculation, they are important for production and should be considered.

The purpose of making these calculations is to prevent the cost of holding excess inventory, as well as to prevent the cost of holding stock. Not holding stock or staying below the safety stock will result in production losses and thus operating losses. The losses caused by urgent purchasing operations will be added on top of this loss. Storage conditions affect production quality. Every material should be stored under necessary conditions. Suitable areas should be created for materials that require certain humidity, temperature and UV conditions. Storage conditions will affect both indirect and direct production costs.

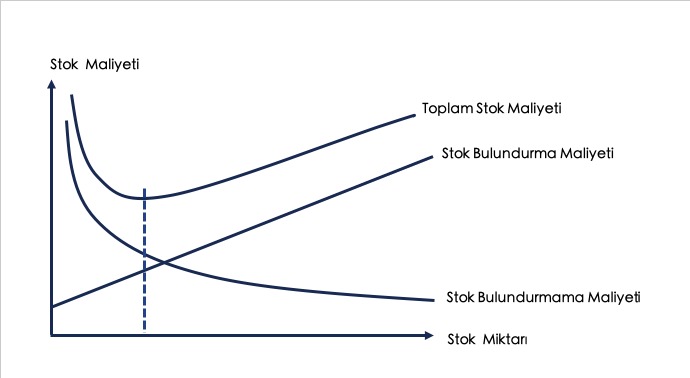

Determining the optimum stock amount is vital for all businesses. The minimum inventory cost and the non-stocking cost are reciprocally cost factors. You can see this situation in the chart below.

The main reason for keeping stock is to keep the business running nonstop. With this; It contributes to supply and demand fluctuations, collective purchasing benefit, inflation gain, efficient use of labor, effective production planning and sales.

- Log in to post comments