According to the report prepared by the International Energy Agency (IEA) in July 2020 with the IMF; Due to the Covid-19 outbreak, global energy demand was expected to decrease by 6% in 2020 compared to the previous year, but electricity from renewable energy sources was expected to increase by 5%. Although the odds changed slightly, the expected for 2020 came true. However, the data show that the increase in the coming period is much greater.

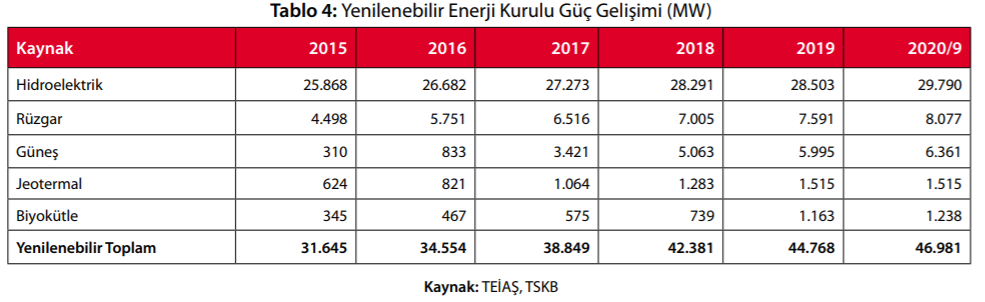

As can be seen in the table below, the installed capacity of our country's renewable energy is increasing every year, and starting from recent years, solar energy and electricity generation gain importance with new policies and incentive systems.

This situation is not only in our country; It is proceeding in the same way in Europe, America and the Far East.

American administration; announced that they aim to reduce electricity generation costs by 60% in the next 10 years and 100% clean energy by 2035.

European countries are also planning to increase renewable energy sources and announce their support.

Far East countries, especially China; They are introducing new taxes and barriers to exports of raw materials to support renewable energy and electricity generation and imports to support domestic producers. Finally, China has enacted a law that prevents exports of polysilicon in order to avoid raw material shortages for domestic producers. This attitude of China, which is the locomotive country for solar energy production raw materials and equipment, will affect world raw material security.

At the forum held in China this month, Zhu Yuqiang, Head of Ping An Bank's Energy Finance Department, pointed out that the country's energy structure is undergoing radical changes and the photovoltaic industry will open up new opportunities. Under the background of the national "zero carbon" strategy, the annual new investment scale of photovoltaic and wind power plants will reach 600 billion yuan; He also explained that on the production side, the development of photovoltaic cells will continue to reduce the cost of photovoltaic power generation by 20-45%. However, six major module manufacturers in China announced that they will double their production this year. These top-notch manufacturers hold up to 70% of the country's market.

According to China's long-term plan; It is planned to increase the proportion of non-fossil energy in primary energy consumption to 20% by 2030. 2030 renewable energy development targets; Hydroelectric 500GW, wind power 400GW, photovoltaic 600GW, biomass 50GW, nuclear power 200GW. Therefore, photovoltaic power generation will become the fastest growing industry in renewable energy in the future.

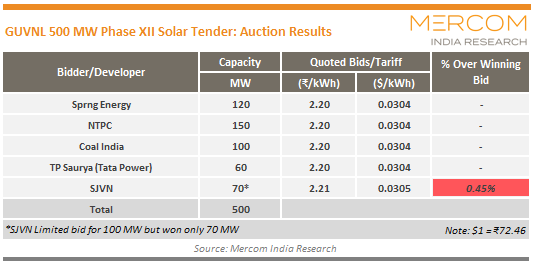

Strong countries in the industry such as India are moving at the same pace. On March 22, five companies won the 500MW (12th) photovoltaic tender held by GUVNL in Gujarat. The tender ended with a price of 3.04 cents / kWh.

Compared to the 500MW auction held by GUVNL in December last year, this auction was realized with an increase of 11%.

Polycrystalline silicon currently accounts for 90% of Indian producers' production capacity. During 2021, 50-60% of projects in India will require the use of monocrystalline PERC modules. From a global demand perspective, it will be a problem for Indian producers, especially monocrystalline PERC. This problem may also cause raw material shortages for producers all over the world. For the 300 GW installed capacity target by 2030, India needs to add about 30 GW of photovoltaic installations each year. Including all announced investments, its capacity is only 20 GW. So 10 GW is missing each year. In order to complete this deficit, the investment and therefore the raw material requirement will grow rapidly. The market is shifting from polycrystalline to monocrystal and at the same time the demand for bifacial modules is increasing. However, frames, photovoltaic glass and foil, and other panel raw materials in particular could pose a global problem.

Due to the Covid-19 outbreak, while strict measures implemented by governments around the world cause delays in projects, the effects on the solar energy sector are expected to gradually decrease and the demand for global modules is expected to increase in the coming period. It is estimated that global module demand will increase by 15% to 143.7 GW in 2021. There will be about 20 countries reaching the GW scale next year. China, USA, India and Europe will lead the growth of solar energy, together representing more than 70% of global market demand.

Strong demand will continue in Europe, which is bound by the Paris Agreement. With the gradual reduction of the ITC, along with the renewable energy target set by each state, it is estimated that the US will witness more than 30% growth. It is estimated that the Indian market, devastated by the pandemic, will return from the virus decline while expected to grow 60%. Aside from traditional markets, emerging markets are also noteworthy. Asia Pacific is

- Log in to post comments